|

Getting your Trinity Audio player ready...

|

Table of Contents

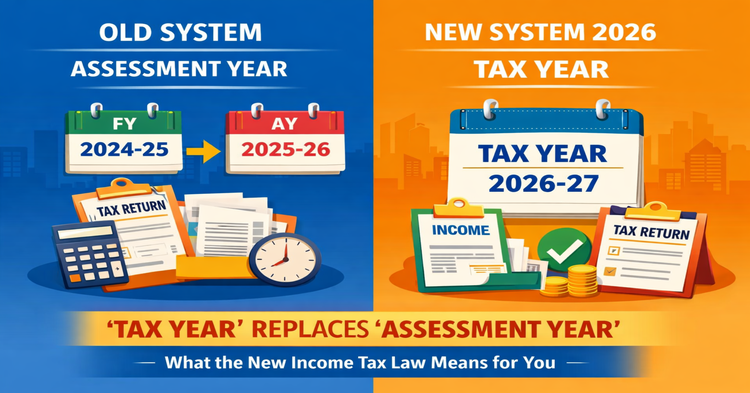

Toggle‘Tax Year’ Replaces ‘Assessment Year’: What the New Income Tax Law Means for You

For years, Indian taxpayers have been confused by terms like Financial Year, Previous Year, and Assessment Year. A common question we hear at CharteredHelp is:

“I earned income this year, then why am I filing it for next year?”

To solve this long-standing problem, the government has introduced a major conceptual change in the New Income Tax Act, 2025. From 1st April 2026, the term Assessment Year will be replaced by Tax Year.

This change is designed to make tax filing simpler, clearer, and more user-friendly for every taxpayer in India.

The Old System: Why It Was Confusing

Under the existing Income Tax Act, 1961:

The year in which you earn income is called the Financial Year (FY)

The year in which that income is taxed is called the Assessment Year (AY)

| Term | Meaning |

|---|---|

| Financial Year (FY) | The year in which income is earned |

| Assessment Year (AY) | The next year in which that income is taxed |

Example

If you earned income between April 2024 and March 2025:

Financial Year: 2024–25

Assessment Year: 2025–26

This meant that income earned in one year was filed in the next year.

For professionals, this made sense. But for common taxpayers—especially:

First-time filers

Small business owners

Freelancers

Salaried individuals

…it created confusion and mistakes.

At CharteredHelp, we often hear:

“Which year’s return am I filing—this year or last year?”

What Is ‘Tax Year’ in New Income Tax Act 2025?

Tax Year is the same year in which income is earned and reported.

There will no longer be two different years to remember.

So instead of:

Income in FY 2026–27

Filed in AY 2027–28

It will become:

Income in Tax Year 2026–27

Filed in Tax Year 2026–27

This is the core difference in Tax Year vs Assessment Year in India.

Tax rates, slabs, deductions, and exemptions remain unchanged.

How ‘Tax Year’ Changes the System

| Old System | New System (From April 2026) |

|---|---|

| Financial Year + Assessment Year | Only Tax Year |

| Income earned in one year, filed in the next | Income and filing in the same year |

| Two timelines to remember | One clear timeline |

| Confusing for common taxpayers | Easy for everyone |

| Higher chance of mistakes | Fewer errors |

This is a structural and procedural change.

Tax rates, slabs, and exemptions remain unchanged.

What Will Change in Tax Filing?

From 2026 onwards:

ITR forms will mention Tax Year, not Assessment Year

Notices and emails from the department will use “Tax Year”

Tax communication will become simpler

First-time filers will find the process easier

The government’s goal is simple:

Remove technical language and make tax compliance user-friendly.

Impact on 2025–26 ITR Filing

The new system will be implemented from 1 April 2026, so its full impact will be seen from the 2026–27 filing cycle onwards.

However, taxpayers should already be aware because:

Future ITR forms will shift terminology

Notices and assessments will use “Tax Year”

The entire language of compliance will change

Understanding this now will help you avoid confusion in the coming years.

What the New ‘Tax Year’ System Means for the Average Indian Taxpayer

For ordinary taxpayers, this change brings much-needed clarity. The long-standing confusion of “earning income in one year and filing it in the next” will finally come to an end. With the introduction of the Tax Year, the year in which you earn income will be the same year in which you file your return.

This makes the tax system far more intuitive, especially for first-time filers, small business owners, freelancers, and salaried individuals who often struggle with technical terms. Instead of remembering two different years, taxpayers will now deal with just one clear timeline.

The shift to Tax Year reflects the government’s broader aim—to make tax compliance simpler, more transparent, and easier for the common citizen under the new income tax law.

Real Client Scenario from Our 10+ Years of Experience

A small business owner once told us:

“I already filed my return last year. Why am I getting a notice again?”

After checking, we found:

He earned income in FY 2022–23

But he selected AY 2023–24 thinking it meant “next income year”

The correct return for that income was never filed

Result:

Late filing fees

Interest

Income Tax notice

This entire problem existed only because of confusion around “Assessment Year”.

With the Tax Year system, such mistakes will reduce drastically.

Practical Tips for Taxpayers

From 2026 onwards, remember:

Income Year = Filing Year = Tax YearSave documents year-wise as:

Tax Year 2026–27

Tax Year 2027–28

Update your accounting or bookkeeping systems to match the new terminology.

Never ignore a notice just because the year sounds confusing—always verify it with a professional.

How CharteredHelp Supports You

At CharteredHelp, we simplify tax and compliance for individuals and businesses in Noida and across India.

We assist with:

Income Tax Return Filing

GST Registration

Company Registration

Ongoing Compliance & Advisory

Our mission is clear:

Make tax easy, transparent, and stress-free for you.

Whether you are:

A salaried employee

A freelancer

A startup founder

A small business owner

We ensure your compliance is accurate and timely.

📞 Call / WhatsApp: +91-9266685656

FAQ's for Tax Year for New Income Tax Law

Tax Year is the new term introduced in the New Income Tax Act, 2025. It refers to the same year in which income is earned and reported. From April 1, 2026, it will replace both “Previous Year” and “Assessment Year”.

Assessment Year is being removed because it confused most taxpayers. People often struggled to understand why income earned in one year was filed in the next year. The new Tax Year system removes this confusion by using a single, clear timeline.

The Tax Year system will come into effect from April 1, 2026. Its practical impact will be seen in ITR filings from the 2026–27 cycle onwards.

No. This is only a terminology and process change.

Your tax rates, slabs, deductions, and exemptions will remain exactly the same.

With Tax Year, the year in which you earn income will be the same year in which you file your return. You will no longer need to remember two different years, which reduces mistakes and makes filing more intuitive.

Yes. For returns filed before April 1, 2026, the existing system continues.

Assessment Year will still apply for the 2025–26 filing cycle.

Tax Year will start after that.

This change is especially helpful for:

First-time taxpayers

Freelancers and consultants

Small business owners

Salaried individuals who file on their own

It simplifies understanding and reduces filing errors.

Yes, until the new system fully begins. Even today, selecting the wrong Assessment Year can lead to:

Late fees

Interest

Income Tax notices

That’s why professional guidance is important.

Yes. From 2026 onwards, businesses should align their accounting and record-keeping with the new “Tax Year” terminology to avoid confusion during audits and compliance.

If you are unsure about:

The new Tax Year system

ITR filing

GST registration

Any compliance issue

You can connect with CharteredHelp.