|

Getting your Trinity Audio player ready...

|

Table of Contents

ToggleGST Compliance

GST Compliance is one of the most critical responsibilities for any business registered under Goods and Services Tax in India. Even a small mistake—such as missing a return filing date or issuing an incorrect invoice—can lead to penalties, interest, GST notices, or even cancellation of registration.

At CharteredHelp, Noida, we have handled GST compliance for businesses for over a decade. Based on real client cases, this guide explains GST Compliance in simple language, covering registration, returns, penalties, benefits, and common mistakes businesses make.

What is GST Compliance?

GST Compliance means following all rules and legal requirements prescribed under the GST Act, including:

Obtaining GST registration when required

Issuing GST-compliant tax invoices

Filing GST returns on time

Paying GST liability within due dates

Maintaining proper records

In simple words, if your business is registered under GST, you must regularly report sales, pay tax, and file returns correctly.

Why GST Compliance is Important for Businesses

GST Compliance is not just a legal formality. It directly impacts:

Business cash flow

Input Tax Credit (ITC) availability

Relationship with vendors and customers

Chances of GST scrutiny or notices

👉 Real Insight:

Many clients come to us only after receiving GST notices. In most cases, the issue started with non-compliance, not tax evasion.

Key Components of GST Compliance

GST Compliance broadly includes five major areas:

GST Registration Compliance

Tax Invoice Compliance

GST Return Filing Compliance

GST Tax Payment Compliance

Record Maintenance Compliance

A business is considered GST-compliant only when all five areas are followed properly.

GST Registration Compliance

GST registration is mandatory when turnover crosses:

| Business Type | Threshold Limit |

|---|---|

| Goods | ₹40 lakh |

| Services | ₹20 lakh |

| Inter-state supply / E-commerce | Mandatory |

Registration Compliance Includes:

Timely GST registration

Correct business details on GST portal

Updating changes in address, partners, or business activity

Client Scenario:

A Noida-based service provider delayed GST registration by 8 months. Result?

- Backdated tax liability

- Interest + penalty

- Loss of ITC for earlier invoices

GST Return Compliance

GST return compliance is the most common area where businesses fail.

Major GST Returns:

| Return | Purpose | Due Date |

|---|---|---|

| GSTR-1 | Sales details | 11th of next month |

| GSTR-3B | Tax payment | 20th of next month |

| GSTR-9 | Annual return | 31st December |

Note: Even Nil return filing is mandatory.

Practical Issue We See Often:

Clients assume “no business = no return”. This leads to:

Late fees accumulation

Portal block for return filing

GST notices

GST Penalties & Consequences of Non-Compliance

Non-compliance under GST can be costly.

Common Penalties:

Late fee: ₹50 per day (₹20 for Nil return)

Interest: 18% per annum

ITC reversal

GST registration cancellation

Real Case:

One trader missed returns for 6 months. GST portal blocked filing, ITC got frozen, and vendor stopped supplies.

Common GST Compliance Mistakes

From our 10+ years of experience at CharteredHelp, these are the most common mistakes:

Not reconciling GSTR-1 with GSTR-3B

Claiming excess ITC without 2B matching

Incorrect HSN or GST rate on invoices

Missing Nil returns

Ignoring GST notices

These are avoidable mistakes with proper compliance support.

Practical GST Compliance Tips (Expert Advice)

- Maintain monthly GST checklist

- Reconcile sales and ITC regularly

- File Nil returns on time

- Respond to GST notices promptly

- Use professional GST compliance services

Tip: GST compliance is easier when handled monthly, not at year-end.

Latest GST Compliance Updates

CBIC has clarified that officers should not ask unnecessary documents during GST registration

Registration applications must be processed within defined timelines

Physical verification to be used only in risk-based cases

These updates aim to reduce harassment and improve ease of doing business.

Benefits of Staying GST Compliant

No GST notices or penalties

Smooth ITC flow

Better business credibility

Easy bank loans & tenders

Stress-free operations

Simply put, GST compliance protects your business reputation and finances.

Why Choose CharteredHelp for GST Compliance?

At CharteredHelp, Noida, we provide end-to-end GST compliance services, including:

- GST registration

- Monthly & quarterly return filing

- GST notice handling

- ITC reconciliation

- Advisory & compliance review

📞 Call Now: +91-9266685656

📍 Location: Noida, Uttar Pradesh

Let our experts handle GST compliance while you focus on growing your business.

Conclusion

GST Compliance is not optional—it is a continuous responsibility. With changing rules and strict enforcement, businesses must adopt a systematic approach to GST registration, returns, and tax payments.

Partnering with experienced professionals like CharteredHelp ensures error-free compliance, reduced risk, and long-term business stability.

FAQ's for GST Complaince

You can check GST Compliance through a simple monthly review:

Login to the GST portal and verify whether GSTR-1 / GSTR-3B for the month are filed and submitted.

Check Electronic Cash Ledger and Electronic Liability Ledger to confirm taxes are paid and liability is cleared.

Review GSTR-2B to ensure your ITC eligibility is reflected and reconcile with purchase invoices.

Confirm there are no pending notices (Dashboard/Notices & Orders section).

If applicable, verify e-way bills, invoice series, and HSN/SAC correctness.

For GST Compliance Rating-related checks, the GST portal user guide indicates that a taxpayer’s “GST Compliance Rating” can be viewed/used while searching taxpayers.

GST non-compliance means not following mandatory GST requirements, such as:

- Not taking GST registration when required

- Issuing incorrect invoices (wrong GST rate/HSN, missing GSTIN details)

- Late or non-filing of returns (even Nil returns)

- Not paying GST collected or payable within due dates

- Claiming ineligible ITC or claiming ITC without GSTR-2B support

GST Compliance becomes mandatory once you are required to register under GST or you voluntarily register. Common threshold guidance is:

Goods: ₹40 lakh (in many states)

Services: ₹20 lakh

Certain categories (for example, some inter-state supply and e-commerce cases) may require registration irrespective of turnover, depending on facts and category.

(Threshold overview references commonly used limits.)

Practically, people mean: What is the penalty for non-compliance under GST?

Key consequences include:

Late fee for delayed return filing: typically ₹50/day (₹25 CGST + ₹25 SGST) and ₹20/day for Nil returns (₹10 + ₹10).

Interest on delayed tax payment: the law permits interest up to 18% as notified; interest commonly applies on delayed payment of tax.

ITC impact: mismatch with GSTR-2B can lead to ITC denial/reversal and follow-up notices.

Operational impact: blocked filing after prolonged default and higher scrutiny risk.

A practical GST Compliance framework has five pillars:

Registration compliance (correct registration, timely amendments)

Invoice compliance (proper tax invoice, HSN/SAC, rate, place of supply, series control)

Return filing compliance (GSTR-1, GSTR-3B, annual return where applicable; QRMP as applicable)

Tax payment compliance (correct tax computation, timely payment, interest if any)

Record maintenance compliance (purchase/sales registers, e-invoices/e-way bills, reconciliation workings)

The GST law provides for a GST Compliance Rating so that registered persons may be assigned a score based on compliance behaviour and such rating may be placed in the public domain.

In practice, the purpose is to:

Promote disciplined filing and timely tax payments

Help buyers evaluate suppliers’ compliance behaviour before doing business

Reduce friction in vendor onboarding and due diligence

The GST portal tutorial also describes the rating concept and scale in its user guide context.

In our professional handling of GST matters, the most frequent practical issue is ITC claimed without matching GSTR-2B (vendor did not file, filed late, or invoice is reported incorrectly). This often triggers:

ITC differences during reconciliation

Notices for mismatch

Working capital blockage until vendor correction or alternative documentation is arranged

In many cases, yes. If you are registered under GST, Nil returns may still be required for the period to stay GST compliant and avoid late fee exposure.

A practical approach:

- Monthly reconcile Sales Register vs GSTR-1 vs GSTR-3B

- Monthly reconcile Purchase Register vs GSTR-2B

- Keep invoice series disciplined and correct HSN/GST rates

- Track due dates and pay liability before filing

- Respond to portal notices promptly with documentation

Yes. CharteredHelp (Noida) provides complete GST Compliance support including registration, amendments, returns (monthly/QRMP), ITC reconciliation, and notice handling.

Call/WhatsApp: +91-9266685656 (Noida)

Recent Posts

GST Compliance Explained: Registration, Returns, Penalties & Benefits

GST Compliance GST Compliance is one of the most critical responsibilities for any business registered under Goods and Services Tax...

ITR Notice Received? What to Do Next

ITR Notice Received? What to Do Next (Step-by-Step Guide) If you have recently seen an email or message from the...

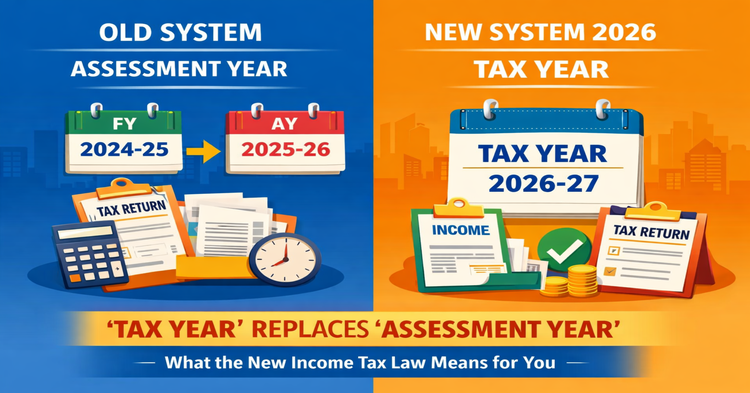

Tax Year Replaces Assessment Year

‘Tax Year’ Replaces ‘Assessment Year’: What the New Income Tax Law Means for You For years, Indian taxpayers have been...

GST on Gold Jewellery in India

GST on Gold Jewellery in India – Rates, Making Charges & Practical Guide (2026) When you buy gold jewellery, you...