GST on Bricks

GST on Bricks in 2026: Latest GST Rate on Bricks, HSN Code & Impact on Brick Manufacturers GST has reshaped taxation in India since its

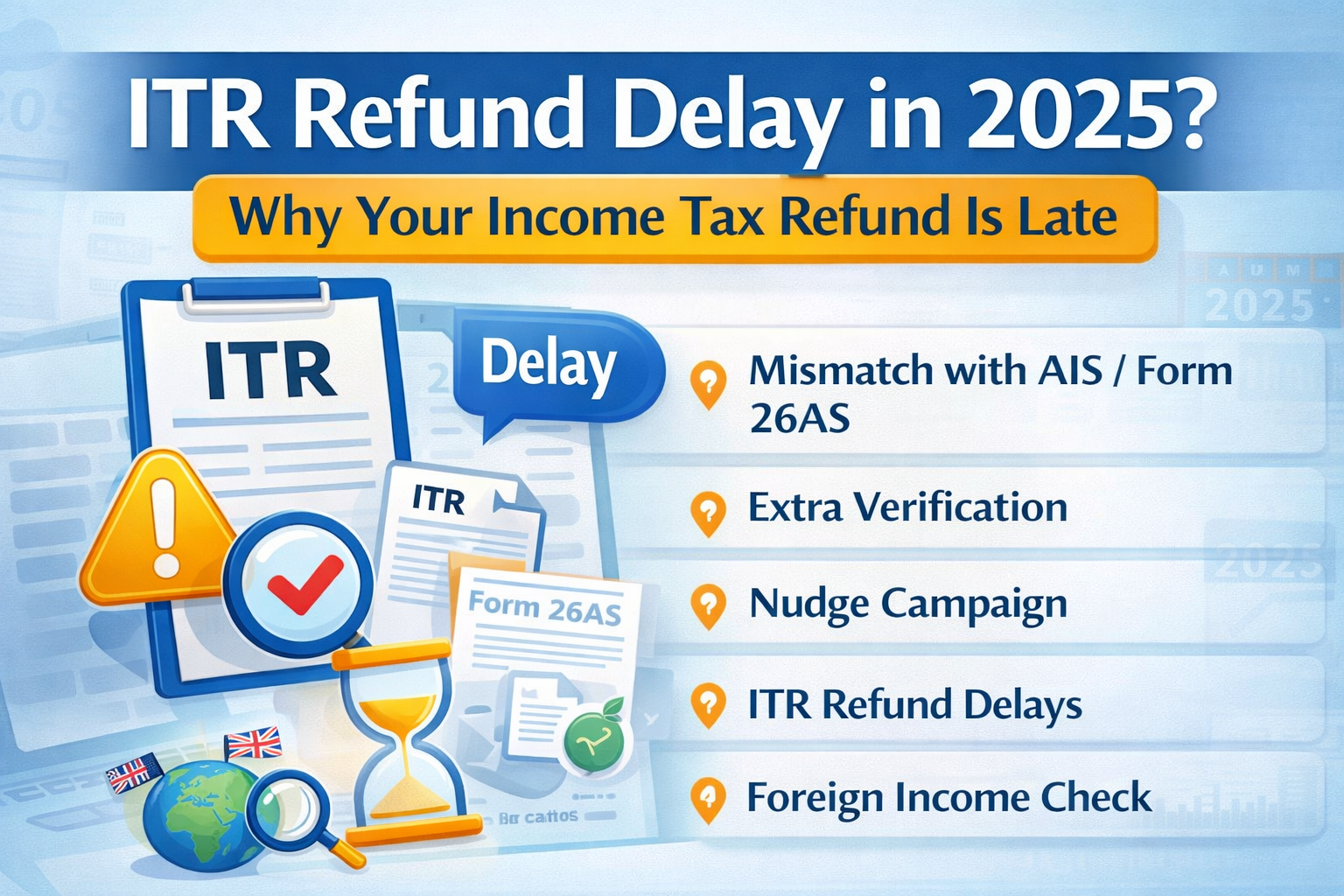

ITR Refund Delay

Main Reasons Why ITR Refunds Are Delayed Mismatch Between ITR and AIS / Form 26AS Income Tax “Nudge” Campaign Late Release of ITR Forms Extra

GST Notice Reply

Received a GST Notice? Types of GST Notices & How to Reply Online Receiving a GST notice can be stressful, especially for small business owners,

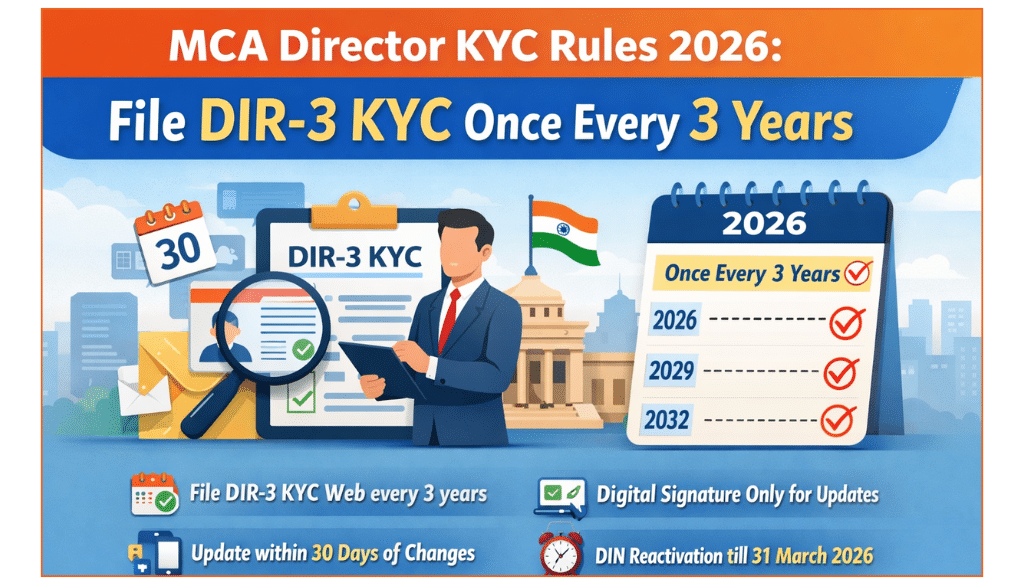

MCA Director KYC Rules 2026

MCA Director KYC Rules 2026: File DIR-3 KYC Once Every 3 Years The Ministry of Corporate Affairs (MCA) has announced a significant change in Director

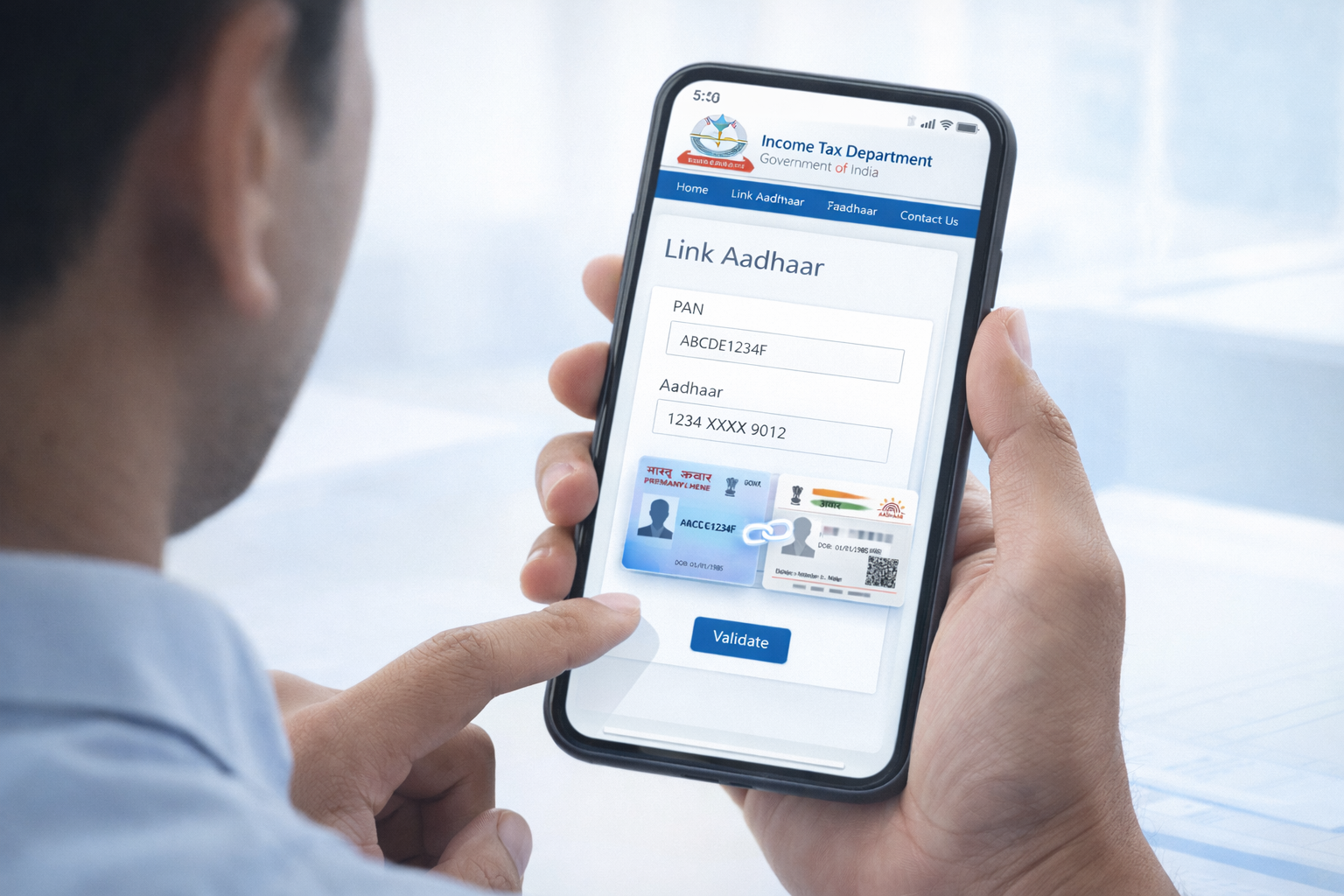

Pan Card & Aadhar Link 2026

Pan Card & Aadhar Link 2026 – Complete Step-by-Step Guide Is your Pan card not linked with your Aadhar yet? If yes, your Pan may

New Rent Agreement Rules 2025

New Rent Agreement Rules 2025: Digital Stamp, Deposit Limits & Penalties From 2025, the rental system in India is becoming more structured and transparent. The

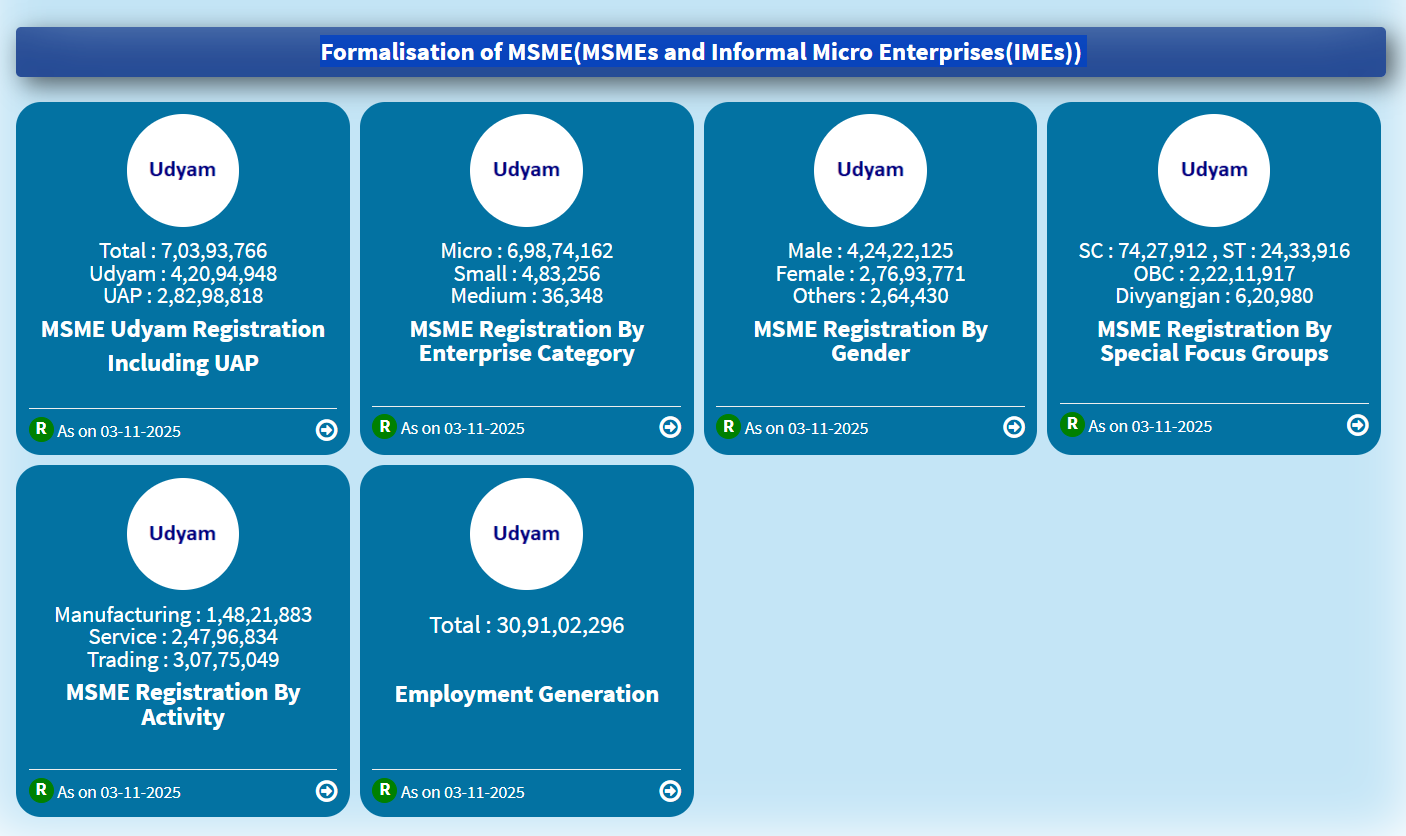

Udyam Registration in Noida

Udyam Registration in Noida — A Complete Guide for Small Businesses If you are running a small or medium business in Noida, you’ve probably heard

Top 8 Income Tax Deductions in New Tax Regime

Introduction When you opt for the new tax regime under Section 115BAC for FY 2025-26 (Assessment Year 2026-27), you accept lower tax rates but lose

Google Map

Recent Posts

Companies Compliance Facilitation Scheme (CCFS), 2026

About Companies Compliance Facilitation Scheme, 2026 The Companies Compliance Facilitation Scheme, 2026 (CCFS 2026) is a one-time compliance window introduced...

MCD Trade License Renewal Online Delhi

MCD Trade License Renewal - Complete 2026 Step-by-Step Guide If your business is running in Delhi, MCD Trade License Renewal...

GST Compliance Explained: Registration, Returns, Penalties & Benefits

GST Compliance GST Compliance is one of the most critical responsibilities for any business registered under Goods and Services Tax...