Table of Contents

ToggleReceived a GST Notice? Types of GST Notices & How to Reply Online

Receiving a GST notice can be stressful, especially for small business owners, traders, startups, and professionals. Many people panic when they see an email or message from the GST department.

But the truth is — GST notices are very common, and most of them can be resolved easily if you reply correctly and on time.

As a Chartered Accountant in Noida, we regularly assist businesses in replying to GST notices online and avoiding penalties.

What is a GST Notice?

A GST notice is an official communication sent by the GST Department to a registered taxpayer when they find any discrepancy, delay, or non-compliance related to GST returns, tax payment, or registration details.

GST notices are issued under different sections of the GST Act, depending on the type of issue.

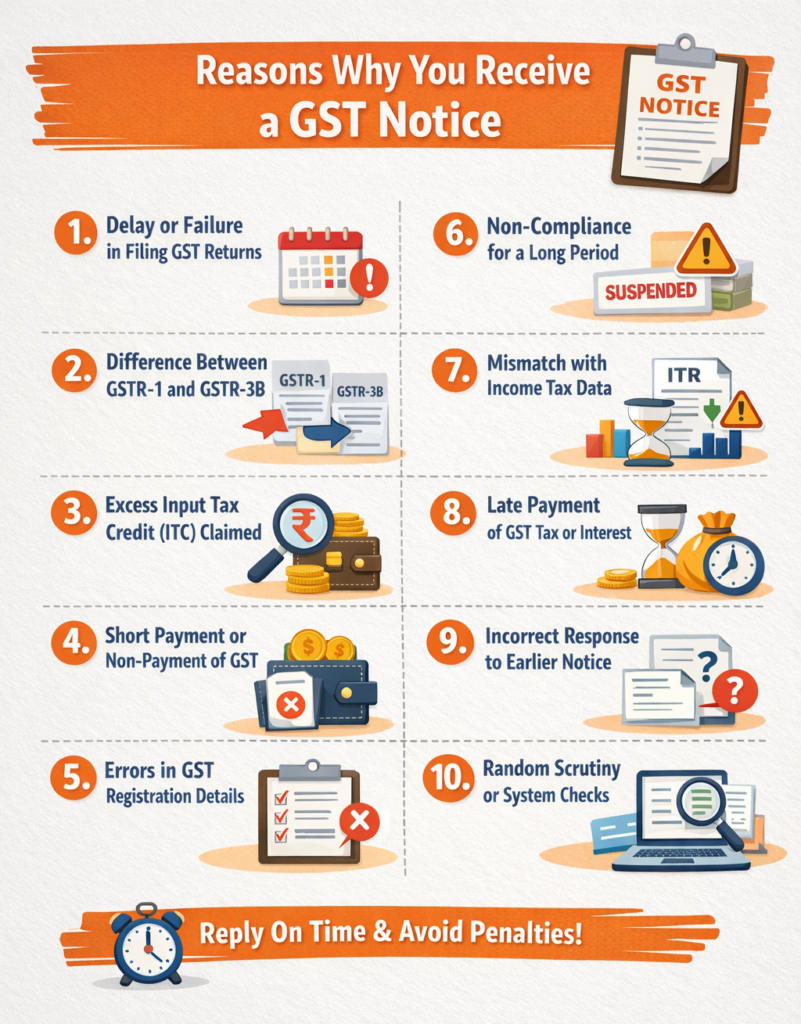

Reasons Why You Receive a GST Notice

A GST notice is issued when the GST Department notices any gap, delay, or inconsistency in your GST compliance. With the government using advanced systems, return data, and tax records are now checked automatically. Because of this, even small errors or delays can result in a GST notice. Below are the most practical and real-life reasons why taxpayers receive GST notices, explained in easy language.

1. Delay or Non-Filing of GST Returns

If you fail to file your GST returns by the due date or skip filing returns for one or more tax periods, the GST system automatically marks your GSTIN as non-compliant. This is one of the most frequent reasons for GST notices being issued.

2. Mismatch Between GSTR-1 and GSTR-3B

When the sales details reported in GSTR-1 do not match the tax liability paid through GSTR-3B, the system identifies the difference. Such mismatches often lead to scrutiny notices asking for clarification.

3. Claiming Higher Input Tax Credit (ITC) Than Allowed

If the ITC claimed by you is more than what is supported by purchase invoices or supplier filings, the GST Department may issue a notice to verify the correctness of the ITC claim.

4. Short Payment or Non-Payment of GST Liability

Errors in calculation, wrong tax rate application, or oversight during payment can lead to underpayment of GST. In such cases, a notice may be issued demanding the short-paid tax along with applicable interest.

5. Incorrect GST Registration Information

Details such as business address, nature of business, additional place of business, or contact details must be accurate. Any incorrect or outdated information can trigger verification and result in a GST notice.

6. Continuous Non-Compliance Over Time

When a taxpayer consistently fails to meet GST compliance requirements for several months, the department may initiate action for suspension or cancellation of GST registration by issuing a formal notice.

7. Difference Between GST Turnover and Income Tax Records

GST data is now compared with Income Tax Returns, AIS, and Form 26AS. A significant difference in turnover or income figures can result in a notice seeking explanation for the mismatch.

8. Delay in Payment of GST or Interest

Even if returns are filed correctly, delay in paying GST dues or interest can attract notices related to late payment and penalties.

9. Incorrect Reply to a Previous GST Notice

If a reply submitted for an earlier GST notice is incomplete, unclear, or lacks proper supporting documents, the GST officer may issue another notice asking for additional explanation.

10. Automated or Random Compliance Checks

Some GST notices are generated due to automated risk analysis or random scrutiny conducted by the system. These checks are meant to ensure overall compliance and do not always indicate a serious issue.

Important Note

Receiving a GST notice does not automatically mean that you have committed a serious mistake. In most cases, it is simply a request for clarification or correction. Responding accurately and within the prescribed time limit can help you resolve the matter smoothly and avoid penalties or further action.

Types of GST Notices

| GST Section | Type of Notice | Reason for Notice |

|---|---|---|

| Section 46 | Non-Filing of Returns | GST returns not filed |

| Section 61 | Scrutiny of Returns | Data mismatch |

| Section 73 | Tax Demand (No Fraud) | Short payment or wrong ITC |

| Section 74 | Tax Demand (Fraud) | Fraud or suppression |

| Section 29 | Cancellation Notice | Non-compliance |

| Section 50 | Interest Notice | Late tax payment |

1. GST Notice under Section 46 – Non-Filing of Returns

This type of GST notice is sent when GST returns remain pending even after the due date has passed. It usually happens when a taxpayer misses filing returns for one or more tax periods.

This is among the most frequently issued GST notices.

What you should do:

File all pending GST returns at the earliest and submit a proper reply on the GST portal.

2. GST Notice under Section 61 – Return Scrutiny

A notice under Section 61 is issued when the GST department reviews your returns and identifies inconsistencies, such as differences between the figures reported in GSTR-1 and GSTR-3B.

What you should do:

Prepare a clear explanation and upload relevant documents to justify the differences.

3. GST Notice under Section 73 & Section 74 – Demand for Tax

These notices are related to tax shortfall or incorrect reporting:

Section 73 applies when the tax issue is not related to fraud or intentional wrongdoing.

Section 74 applies in cases involving fraud, misstatement, or deliberate suppression of facts.

What you should do:

Recheck tax calculations, submit a detailed reply with evidence, or pay the outstanding amount if required.

4. GST Notice under Section 29 – Cancellation of Registration

This notice is issued when the GST department considers cancelling a GST registration due to repeated non-compliance, such as continuous non-filing of returns or violation of GST rules.

What you should do:

Respond within the prescribed time limit with a valid explanation to prevent cancellation of GST registration.

Latest GST Notice Updates

| Update | Details |

|---|---|

| Auto-Generated Notices | Notices issued automatically for mismatches |

| GST & Income Tax Linking | Data matched with AIS & Form 26AS |

| Strict ITC Verification | Fake ITC claims monitored closely |

| Faster Reply Deadlines | Online replies expected quickly |

How to Reply to GST Notice Online (Step-by-Step Guide)

Replying to a GST notice online is compulsory in most cases. Below is the simple step-by-step process:

Login to www.gst.gov.in

Go to Services → User Services → View Notices

Select the relevant GST notice

Upload your reply and supporting documents

Submit using DSC or EVC

Always submit your reply before the due date mentioned in the notice.

Documents Required for GST Notice Reply

Depending on the notice, you may need the following documents:

GST returns (GSTR-1, GSTR-3B)

Sales and purchase invoices

GST payment challans

Explanation letter

Any other supporting proof

Having proper documentation is very important to avoid rejection.

Time Limit to Reply GST Notice

Each GST notice has a specific reply time.

| Notice Type | Time Limit |

|---|---|

| Section 46 | 15 days |

| Section 61 | 7–30 days |

| Section 73/74 | As mentioned in notice |

Missing the deadline can lead to penalty and legal action.

GST Notice Reply Format – Complete Template

GENERAL GST NOTICE REPLY TEMPLATE

Date: [Date of Reply]

To

The Jurisdictional GST Officer / Assistant Commissioner

[Office Name & Address as mentioned in the Notice]

From

[Legal Name of Taxpayer / Business]

[Registered Address]

GSTIN: [GSTIN]

Mobile No.: [Contact Number]

Email ID: [Official Email]

Subject: Reply to GST Notice No. [Notice Number] dated [Notice Date] issued under Section [Relevant Section] of the CGST Act, 2017

Respected Sir / Madam,

We respectfully submit this reply in response to the above-mentioned notice issued to us on [Notice Date]. The said notice raises certain observations in relation to our GST compliance.

We wish to submit our point-wise clarification as under:

Point-Wise Reply

Observation No. 1:

[Briefly reproduce the observation as stated in the notice]

Reply:

[Provide a clear, factual, and concise explanation. Mention relevant period, figures, reconciliation details, and corrective actions, if any.

Example: “The input tax credit pertaining to the said invoices has already been reversed in GSTR-3B for the tax period of __, and applicable interest has been duly paid.”]

Observation No. 2:

[Next observation]

Reply:

[Explanation supported by facts, records, and documents]

Observation No. 3:

[Next observation]

Reply:

[Clarification / compliance status]

(The above format may be continued for all observations contained in the notice.)

Documents Submitted

In support of our submissions, we are enclosing the following documents for your kind verification:

1. Copies of relevant GST Returns (GSTR-1 / GSTR-3B / GSTR-9, as applicable)

2. Tax payment challans / DRC-03 acknowledgements (if any)

3. Copies of purchase and sales invoices

4. Reconciliation statements (2A/2B vs 3B, turnover reconciliation, etc.)

5. Any other relevant supporting documents

Legal Submissions (If Applicable)

Without prejudice, we respectfully submit that the above issue is duly supported by the provisions of the CGST Act, 2017, relevant Rules, Notifications, Circulars, and judicial precedents, wherever applicable.

Prayer / Request

In view of the facts explained above and the documents submitted, we humbly request your good office to kindly accept our explanation and drop further proceedings in this matter.

Thanking You,

Yours Faithfully,

For [Name of Business / Taxpayer]

Authorized Signatory

Name: [Name]

Designation: [Proprietor / Partner / Director / Authorized Representative]

Place: [City]

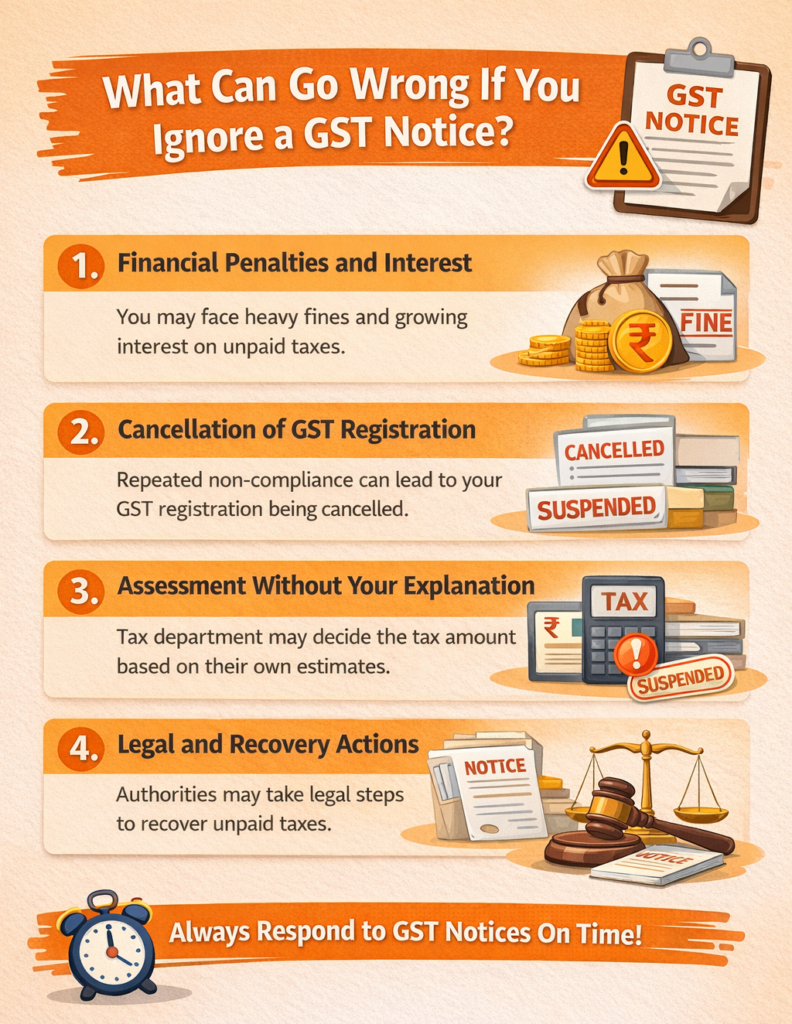

Ignoring a GST Notice? Here’s What Can Happen

Ignoring a GST notice can lead to serious consequences for your business. A GST notice is not just a reminder—it is a formal communication from the tax department that requires timely action. If it is ignored or delayed, the situation can become more complicated and costly.

Below are the possible outcomes of not responding to a GST notice:

1. Financial Penalties and Interest

The GST department may impose penalties along with interest on the outstanding tax amount. These charges continue to increase with time, making the liability much higher than the original amount.

2. Cancellation of GST Registration

Repeated non-compliance or failure to reply may result in suspension or cancellation of your GST registration. Once cancelled, continuing business operations becomes difficult and legally risky.

3. Assessment Without Your Explanation

If no reply is submitted, the GST officer can complete the assessment based on available information. This means the tax demand may be decided without considering your side of the story.

4. Legal and Recovery Actions

In serious cases, the department may initiate recovery proceedings or legal action to collect the outstanding dues, which can impact business reputation and finances.

GST notice replies should always be drafted carefully. A wrong or incomplete reply can lead to penalties or cancellation of registration. Professional assistance is strongly recommended.

Why Hire a CA for GST Notice Reply in Noida?

Replying to a GST notice requires technical knowledge and legal understanding. A small mistake can result in penalties.

As a Chartered Accountant in Noida, we provide:

Accurate reply drafting

Complete document verification

Online submission support

Penalty prevention

Professional help ensures peace of mind.

Need Help Replying to a GST Notice in Noida?

If you have received a GST notice and are confused about how to reply, get expert assistance today.

📞 Call Now: +91-9266685656

Chartered Accountant in Noida – GST Notice Reply & Compliance Support

Frequently Asked Questions for GST Notice

1 What is a GST notice?

A GST notice is an official communication from the GST Department asking a taxpayer to clarify discrepancies, correct errors, or submit pending returns or payments.

2 Why do I receive a GST notice?

You may receive a GST notice for reasons like late filing of returns, mismatched data between GSTR-1 and GSTR-3B, excess ITC claimed, or discrepancies with Income Tax data.

3 What are the types of GST notices?

Common types include:

Section 46 – Non-filing of returns

Section 61 – Scrutiny of returns

Section 73/74 – Tax demand

Section 29 – Cancellation of registration

Section 50 – Interest notice

4 How do I reply to a GST notice online?

Login to the GST portal, go to Services → User Services → View Notices, select the notice, attach a reply and supporting documents, and submit using DSC or EVC.

5 What documents are needed to reply to a GST notice?

Documents like GST returns (GSTR-1/GSTR-3B), payment challans, invoices, reconciliation statements, and other proof supporting your claim are usually required.

6 How much time do I have to reply to a GST notice?

Time limits vary:

Section 46: 15 days

Section 61: 7–30 days

Section 73/74: As mentioned in the notice

Replying late can attract penalties.

7 What happens if I ignore a GST notice?

Ignoring a GST notice can lead to penalties, interest, cancellation of GST registration, assessment without your explanation, or even legal action.

8 Do I need a CA to reply to a GST notice?

While it’s possible to reply yourself, hiring a Chartered Accountant ensures correct, professional, and timely responses, minimizing risk of penalties.

9 Can I request a personal hearing for a GST notice?

Yes, if required, you can request a personal hearing to explain your case directly to the GST officer.

CharteredHelp is a team of experienced professionals providing tax, accounting, auditing, and compliance services for businesses and individuals. With over 10+ years of experience, we assist clients with GST registration and filings, income tax returns, company registration, trademark services, accounting, auditing, and handling tax notices. Our focus is on providing practical, reliable, and timely support to help clients stay compliant and grow their businesses with confidence.