Table of Contents

ToggleGST Registration for Proprietorship & Documents

In this blog, we will explore the key aspects of GST registration for proprietorship firms, discuss the process, eligibility, benefits, and highlight the new GST registration documents for proprietorship that you need to keep ready.

What is GST Registration for Proprietorship?

GST registration is a process by which a proprietorship business obtains a unique GST Identification Number (GSTIN) from the government for paying taxes on goods and services supplied. Proprietorships, being one of the most common forms of business entities in India, must ensure they register under GST when they meet certain criteria such as turnover limits or interstate dealings.

Who Needs GST Registration for Proprietorship?

- Businesses with an annual turnover exceeding ₹40 lakhs (₹10 lakhs for special category states) must register.

- Proprietors involved in interstate supply of goods or services.

- Proprietors supplying goods through e-commerce platforms.

- Those engaged in casual taxable supply or non-resident taxable supply.

Benefits of GST Registration for Proprietorship

- Legal recognition as a supplier of goods and services.

- Eligibility to claim input tax credit on purchases.

- Ability to supply goods and services across India easily.

- Avoidance of penalties and legal issues.

- Increased business credibility.

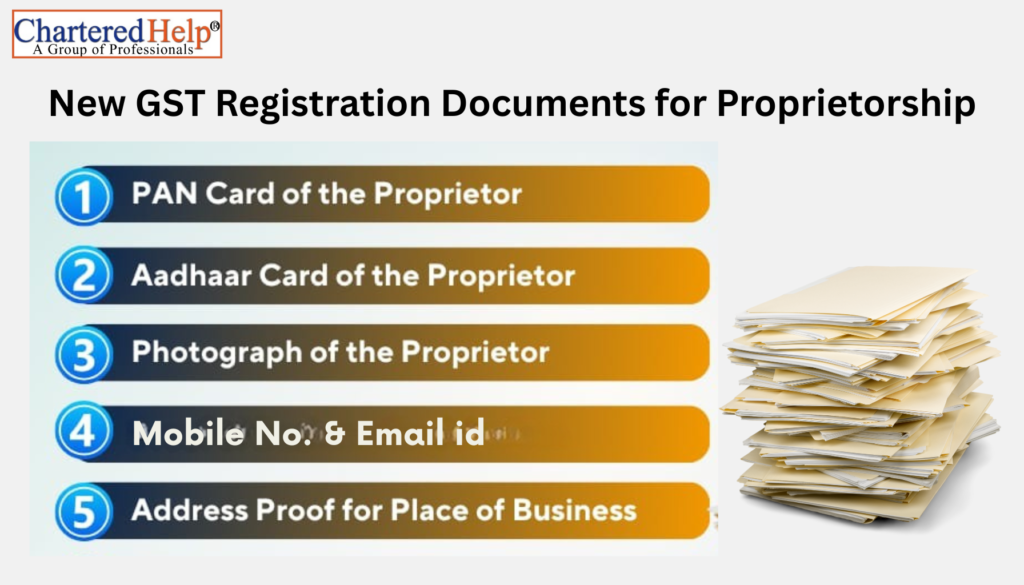

New GST Registration Documents for Proprietorship

To complete the GST registration successfully, proprietorship firms must submit specific documents. The new GST registration documents for proprietorship include:

- PAN Card of Proprietor: Proof of identity and income tax profile.

- Aadhaar Card: Proof of identity and address.

- Photograph of Proprietor: A recent passport-sized photograph.

- Proof of Business Address: This can include:

Rent agreement along with electricity bill or property tax receipt.

Ownership documents of the business premises. - Mobile Number and Email ID: For verification and communication.

Step-by-Step Process for GST Registration for Proprietorship

- Visit GST Portal: Go to the official GST website (https://www.gst.gov.in).

- Create New User: If you are a new user, sign up with your email and mobile number.

- Fill Application Form: Enter details about your business, PAN, address, and business constitution (proprietorship).

- Upload Documents: Upload the new GST registration documents for proprietorship as listed above.

- Verification: Complete Aadhaar-based OTP verification for the proprietor.

- Submit Application: After cross-verifying all details, submit the GST registration application.

- Receive GSTIN: Once verified, the GST officer will approve, and you will receive the GSTIN.

Important Tips for GST Registration for Proprietorship

- Always keep your documents updated and authentic.

- Ensure the business address proof aligns with the Aadhaar address or apply for a separate address proof.

- Regularly check the GST portal for application status.

- Keep digital signature handy for smooth filing of returns.

Conclusion

GST registration for proprietorship is a critical step that enables your business to remain compliant and take advantage of streamlined taxation benefits. Keeping the new GST registration documents for proprietorship organized and ensuring all information is accurately submitted will make the process hassle-free. Whether you are just starting out or expanding your business, timely GST registration can safeguard you from legal penalties and improve your business credibility.

CharteredHelp is a team of experienced professionals providing tax, accounting, auditing, and compliance services for businesses and individuals. With over 10+ years of experience, we assist clients with GST registration and filings, income tax returns, company registration, trademark services, accounting, auditing, and handling tax notices. Our focus is on providing practical, reliable, and timely support to help clients stay compliant and grow their businesses with confidence.