|

Getting your Trinity Audio player ready...

|

Table of Contents

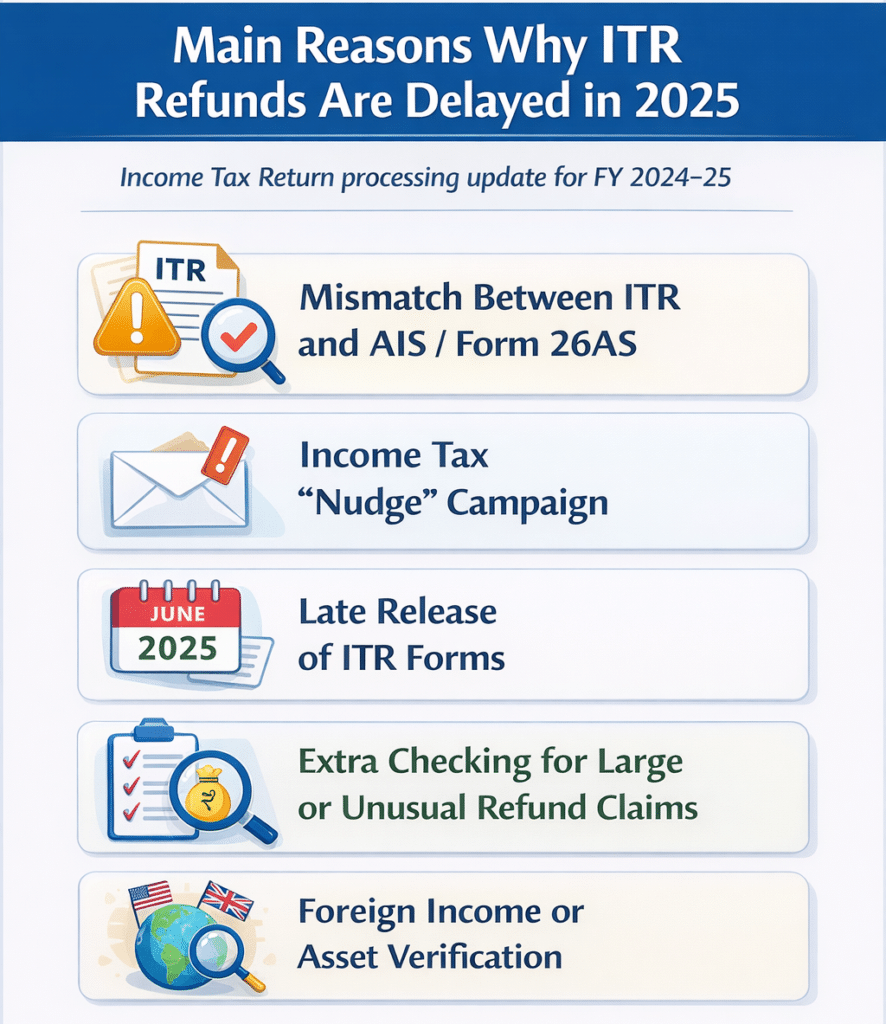

ToggleMain Reasons Why ITR Refunds Are Delayed

- Mismatch Between ITR and AIS / Form 26AS

- Income Tax “Nudge” Campaign

- Late Release of ITR Forms

- Extra Checking for Large or Unusual Refund Claims

- Foreign Income or Asset Verification

Mismatch Between ITR and AIS / Form 26AS

The Income Tax Department now matches your return with multiple data sources such as:

Annual Information Statement (AIS)

Form 26AS

TDS details

Bank interest information

Mutual fund and share transactions

If the income or deduction shown in your ITR does not fully match this data, your return is temporarily held for verification.

Even small differences — like missing bank interest — can delay refund processing.

Income Tax “Nudge” Campaign

In December 2025, the CBDT launched a special “Nudge” campaign.

Under this initiative:

Taxpayers with data mismatches receive SMS or email alerts

They are given time to accept the difference or file a revised / updated return

Until the taxpayer responds, the refund is kept on hold intentionally

This is done to avoid wrong refunds or future tax demands.

Late Release of ITR Forms

For AY 2025–26, several ITR forms and utilities were released later than usual, between June and August 2025.

Because of this:

Filing started late

Processing cycles were pushed back

Refund timelines automatically shifted

Extra Checking for Large or Unusual Refund Claims

Returns showing:

High refund amounts

Sudden increase in income or deductions

are going through additional verification.

This is part of risk-based processing and applies to salaried as well as business taxpayers.

Foreign Income or Asset Verification

The tax department is also matching returns with foreign income and asset data received under international information-sharing agreements.

If foreign income or assets appear undisclosed, taxpayers are asked to revise their returns before refunds are released.

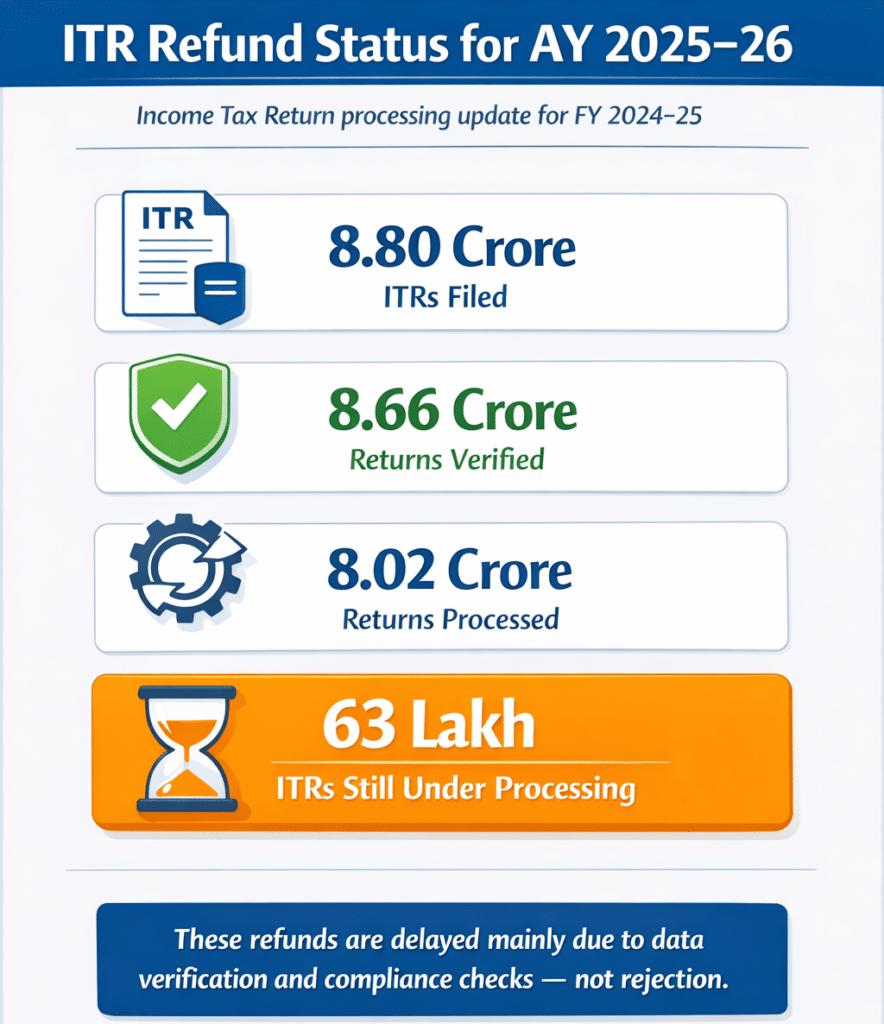

How Many ITR Refunds Are Still Pending in 2025?

As per data available on the Income Tax Department website:

Around 8.80 crore ITRs have been filed for AY 2025–26

Nearly 8.66 crore returns have been verified

About 8.02 crore returns have already been processed

This means around 63 lakh ITRs are still under processing, and refunds for these returns are yet to be issued.

So, if your refund has not arrived yet, you are part of a large group — and there is no need to panic.

Is It Normal If My ITR Refund Is Delayed After December 31?

Yes, it is completely legal and normal.

Under the Income-tax Act, the Centralised Processing Centre (CPC) is allowed up to 9 months from the end of the financial year to process income tax returns.

For returns filed for AY 2025–26 (FY 2024–25), the tax department can legally process returns up to 31 December 2026.

So, a delay after December 31, 2025 does not mean something is wrong with your return.

Will I Get Interest on Delayed ITR Refund?

Yes. The Income-tax Act provides interest on delayed refunds under Section 244A, but certain conditions apply.

Key Points:

Interest rate: 0.5% per month

Refund amount should be more than ₹100 or 10% of total tax paid

For timely returns, interest is calculated from 1 April of the assessment year

For belated returns, interest starts from the date of filing

Example:

If your refund amount is ₹40,000 and it is delayed by 8 months, you may receive ₹1,600 as interest.

Even part of a month is counted as a full month.

What Should You Do If Your ITR Refund Is Stuck?

- Regularly check your AIS and Form 26AS

- Read and respond to SMS or email alerts from the tax department

- File a revised or updated return if there is any mismatch

- Track refund status on the income tax portal

- Do not panic — most refunds are delayed, not denied

Final Words: Should You Worry About ITR Refund Delay?

In most cases, ITR refund delays in 2025 are not due to mistakes or rejection.

The Income Tax Department is simply doing extra checks to ensure accurate data and voluntary compliance.

If your return is correct and you respond to any alerts on time, your refund will be issued — even if it takes longer than expected.

Conclusion

If you have already filed your Income Tax Return (ITR) and are still waiting for your refund, you are not alone. In Assessment Year (AY) 2025–26, lakhs of taxpayers across India are facing delays in receiving their income tax refunds.

Many people are worried because even after the December 31 deadline, their ITR status still shows “Return under processing” and the refund has not been credited yet. The good news is — in most cases, this delay is normal and intentional, not a rejection.

FAQ's for ITR Refund Delay

1 Why is my ITR refund still pending in 2025?

Your ITR refund may be pending due to data verification checks by the Income Tax Department. If there is any mismatch between your return and AIS or Form 26AS, or if your case is selected for additional review, the refund is temporarily held.

2 Is it normal if my ITR refund is delayed after December 31?

Yes. Under the Income-tax Act, the department has time until 31 December 2026 to process returns filed for AY 2025–26. A delay after December 31, 2025 is legally allowed and not unusual.

3 How long does the Income Tax Department take to process a refund?

There is no fixed number of days. Most refunds are processed within a few weeks, but in some cases, processing can take several months depending on verification requirements.

4 What is the Income Tax “Nudge” campaign?

The Nudge campaign is an initiative where taxpayers are informed via SMS or email about mismatches in their returns. The department gives taxpayers a chance to revise or update their returns before issuing refunds or raising demands.

5 Can a simple salaried ITR also face refund delay?

Yes. Even salaried taxpayers can face delays if there is missing bank interest, TDS mismatch, incorrect deductions, or late correction by the employer in Form 16 or TDS returns.

6 Will I get interest if my ITR refund is delayed?

Yes. Under Section 244A, interest at 0.5% per month is payable on delayed refunds, subject to certain conditions such as timely filing and minimum refund amount.

7 From when is interest calculated on delayed ITR refunds?

- For timely filed returns, interest is calculated from 1 April of the assessment year

- For belated returns, interest is calculated from the date of filing

8 How can I check my ITR refund status online?

You can check your refund status by logging in to the Income Tax e-filing portal and visiting the “View Filed Returns” section or by tracking refund status through NSDL.

9 What should I do if I receive an email or SMS from the Income Tax Department?

You should read the message carefully and respond on the income tax portal. If required, file a revised or updated return to correct any mismatch. Ignoring alerts can delay your refund further.

10 Does refund delay mean my return is rejected?

No. Refund delay usually means your return is under processing or verification. In most cases, refunds are released once checks are completed and required responses are submitted.