Table of Contents

ToggleLetter of Authorization for GST Registration [Free Word Format Download]

GST registration is a vital legal requirement for businesses in India. Whether you’re a sole proprietor, a partner in a firm, or part of a company, you’ll often need to designate an authorized person to handle your GST affairs. That’s where a Letter of Authorization for GST comes in. This document allows a nominated individual to act on behalf of a business entity during the GST registration and filing process.

This guide will help you understand the purpose, structure, and legal implications of the letter. Plus, we’ll offer a free downloadable Word format tailored for different business types, including proprietorships, partnerships, LLPs, and private limited companies.

Quick Summary: Letter of Authorization for GST

A Letter of Authorization for GST is a document that allows a business owner to legally authorize another person (partner, director, CA, accountant, or employee) to handle GST registration, filing, and compliance on their behalf. It is mandatory when the authorized signatory is not the business owner.

What is a Letter of Authorization for GST?

A Letter of Authorization for GST is an official document that authorizes an individual, typically a director, partner, manager, accountant, or third-party consultant, to act on behalf of a business entity concerning Goods and Services Tax (GST) matters. This includes GST registration, compliance filing, and attending queries raised by the GST Department.

Why is it Required for GST Registration?

The GST law mandates that only an authorized person can perform actions such as registration, amendment, return filing, and cancellation on behalf of a business. As businesses may appoint employees or external professionals to handle this, a formal authorization letter serves as legal proof of delegation.

This letter is especially important when the business owner is not directly managing GST operations.

Key Components of a GST Authorization Letter

Crafting a legally sound Letter of Authorization for GST requires including certain key components:

Authorized Signatory Information

Full Name

Designation

Contact Number

Email Address

Business Entity Details

Legal Name of Business

Type of Entity (Proprietorship, Partnership, LLP, etc.)

PAN Number

Registered Business Address

Declaration & Signature

A clear declaration appointing the person as an authorized signatory

Signature of the business owner or all partners (if applicable)

Date and place of issue

Official company seal/stamp (if applicable)

Format of Letter of Authorization for GST

The letter typically follows a standard format but can vary slightly based on the type of business entity. It should be printed on official letterhead and signed before being uploaded to the GST portal.

Word Format Preview & Download

This downloadable file includes ready-to-use templates for:

Private Limited Companies

LLPs

Partnerships

Letter of Authorization for GST - Entity Wise Templates

Let’s look at the customized templates for different business structures:

GST Authorization Letter for Proprietorship

Generally, the proprietor makes himself available for GST registration, and after registration compliance, the GST portal does not ask for a letter of authorization in the case of a proprietor.

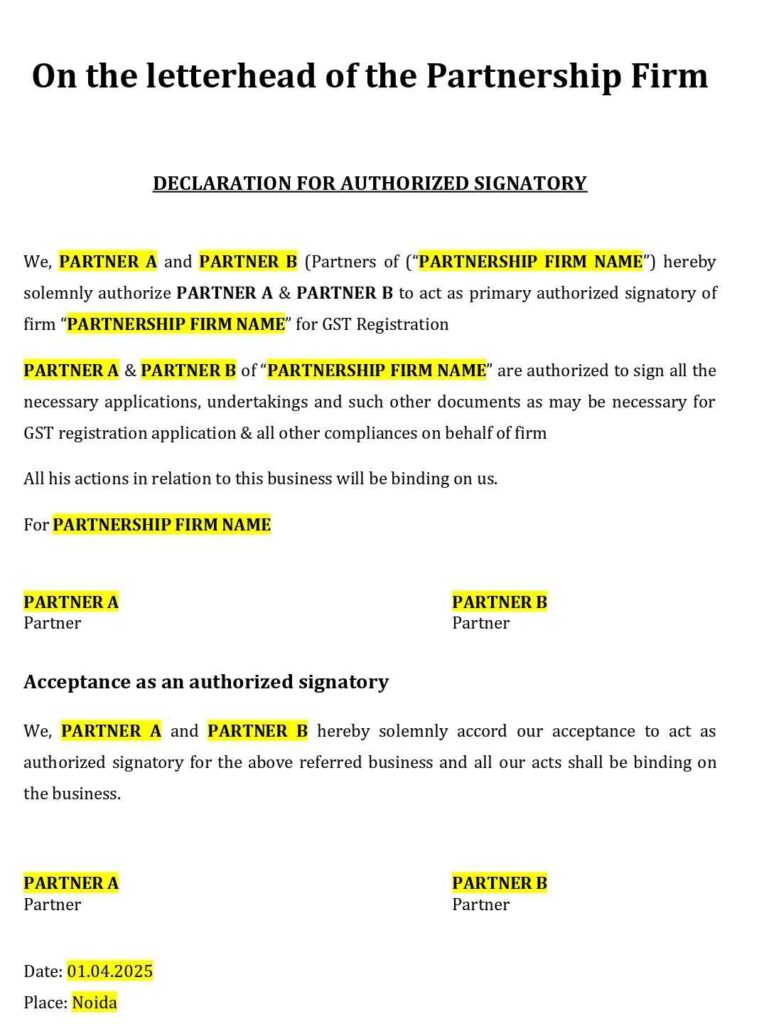

GST Authorization Letter for Partnership Firm

Use case: When one or more partners authorize another partner or external representative.

Format includes: All partner names, firm details, and joint signatures.

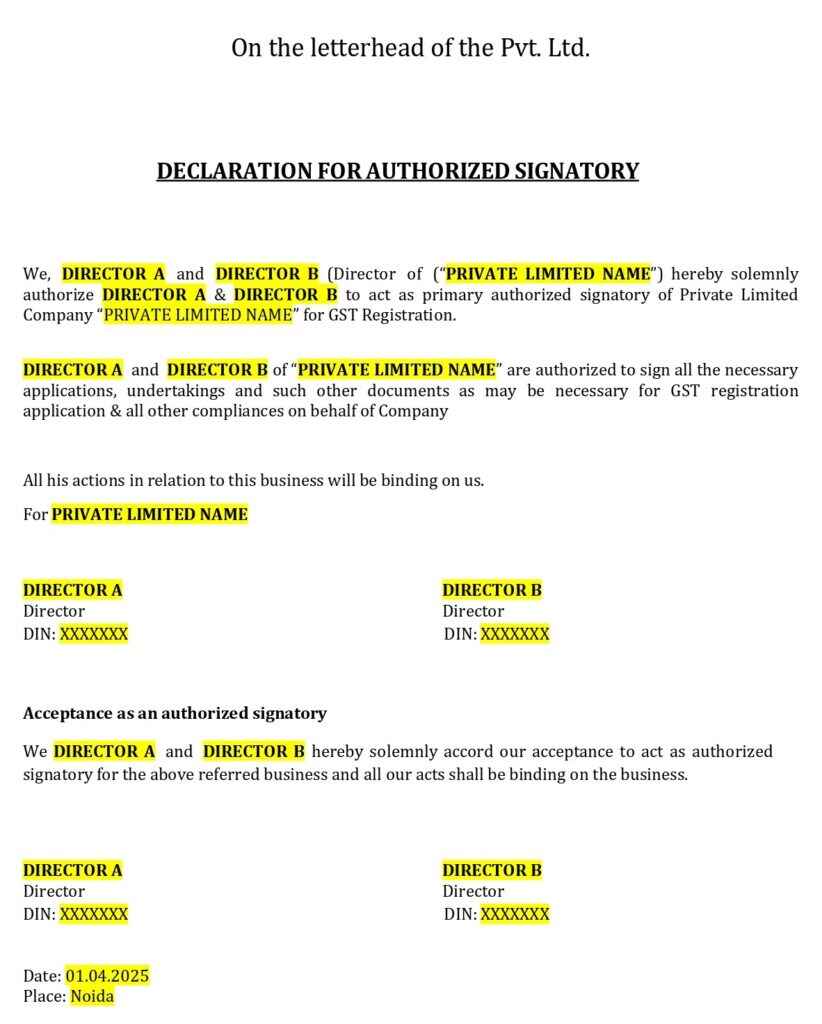

GST Authorization Letter for Private Limited Company

Use case: Requires a Board Resolution along with the letter.

Format includes: Company name, CIN, Board approval note, and MD/Director’s signature.

GST Authorization Letter for LLP

Use case: Appointing a partner or third party to handle GST.

Format includes: LLP registration number, partner details, and signatures.

How to Submit the Authorization Letter During GST Registration

The GST portal requires a scanned copy of the authorization letter while registering. Here’s how:

Upload Procedure on GST Portal

Log in to gst.gov.in

Choose “New Registration”

Fill out business details

In the “Authorized Signatory” section, upload the authorization letter (PDF format)

Submit and verify using DSC, E-Sign, or EVC

Verification and Approval Process

Once submitted, the GST officer may verify the details. Ensure the information in the letter matches the details filled in the application to avoid rejection or delay.

Why GST Authorization Letters Get Rejected

Submitting a Letter of Authorization for GST may look simple, but in practice, this is one of the most commonly flagged documents during GST registration and amendments. GST officers don’t reject applications randomly. Rejections usually happen due to clear, verifiable mismatches or procedural lapses.

Let’s break down the common, practical reasons why GST authorization letters get rejected—and how you can fix them before clicking “Submit”

1. Name Mismatch with PAN Database

This is the number one reason for rejection.

The name mentioned in the authorization letter must exactly match the name as per the PAN records used for GST registration. Even small differences—like missing initials, spelling variations, or extra words—can trigger a mismatch.

Example:

PAN name: ABC Enterprises

Authorization letter: ABC Enterprise

Result: Likely rejection or clarification notice.

Pro Tip:

Always copy the business name directly from the PAN or GST application form instead of typing it manually. One extra “s” can cost you days.

2. Authorization Letter Is Unsigned

Yes, this still happens more often than you’d expect.

An unsigned authorization letter has no legal validity. From a GST officer’s perspective, an unsigned document means no consent was actually given.

Common mistakes include:

Missing signature of proprietor/partner/director

Signature present but no name mentioned

Digital file uploaded before signing (classic hurry mistake)

Logical reality:

If you wouldn’t accept an unsigned cheque, the GST department won’t accept an unsigned authorization letter.

3. Wrong Business Entity Format Used

This mistake quietly kills many applications.

Each business structure follows a different authorization requirement under GST law:

Proprietorship ≠ Partnership

Partnership ≠ LLP

LLP ≠ Private Limited Company

Using a generic or wrong format creates doubt about who actually holds the authority to appoint a signatory.

Examples of common errors:

Partnership firm using a proprietorship-style letter

Private company issuing authorization without board approval reference

LLP missing partner consent wording

Fix:

Always use an entity-specific authorization format aligned with your business constitution.

4. No Board Resolution Attached (For Companies)

For Private Limited Companies, an authorization letter alone is not sufficient.

Under company law principles and GST compliance practice, the power to appoint an authorized signatory flows from the Board of Directors, not an individual director acting alone.

If you upload:

Authorization letter = Right

Board resolution = Wrong

Expect rejection or a clarification notice.

Practical rule:

No board resolution = no proof of authority.

5. Uploaded as Image Instead of PDF

This may sound technical, but GST officers deal with thousands of applications. Poor document format slows verification—and that’s exactly what they don’t want.

Common upload mistakes:

Mobile photos instead of scanned documents

Blurry images

JPEG/PNG files instead of PDF

Why PDF matters:

PDF files preserve formatting, signatures, and clarity. They are easier to archive, verify, and audit.

Safe approach:

Scan the signed letter clearly and upload it as a single, readable PDF file.

6. Issues during Physical Verification

Sometimes, a GST officer may visit your business address to check if the business actually exists. If during this visit the officer does not find a proper name board, finds the office closed, or feels that the place is not suitable for the type of business mentioned in the application, your GST application can be rejected.

If the application is rejected, the GST department issues a rejection notice called FORM GST REG-05. This notice clearly explains why the application was rejected. You must correct those issues and then apply again for GST registration on the GST portal.

Expert Tip

In our GST registration cases, the most common reason for authorization letter rejection is a signature mismatch or a missing board resolution, especially in private limited companies and LLPs. Many applicants upload a correctly drafted letter but overlook small yet critical details such as using the official letterhead, ensuring the authorized signatory’s name matches PAN and GST records, or uploading the document in the prescribed PDF format.

A quick cross-check of the entity type, supporting resolutions, and document format before submission can prevent unnecessary notices, rejections, and delays from the GST department

Entity-wise Requirement of Authorization Letter for GST

| Business Type | Is Authorization Letter Required? |

|---|---|

| Proprietorship | ❌ Usually Not Required |

| Partnership Firm | ✅ Yes |

| Limited Liability Partnership (LLP) | ✅ Yes |

| Private Limited Company | ✅ Yes (Board Resolution Required) |

Legal Implications of a Faulty Authorization Letter

If the letter lacks legal standing, your GST application could be:

Rejected outright

Put on hold for clarification

Delayed significantly, affecting business operations

In worst cases, incorrect authorization may result in penalties or future audits.

Tips for Drafting an Error-Free Letter of Authorization

Always use your official letterhead

Clearly mention roles and responsibilities

Use the correct entity format

Sign and stamp it properly

Keep a digital copy for records

FAQs About GST Authorization Letters

A GST Authorization Letter is a written permission given by a business to a person who will handle GST work such as registration, return filing, or replying to GST notices on their behalf.

Yes, especially if someone other than the business owner is the authorized signatory.

Yes, Chartered Accountants or tax consultants can be appointed using this letter.

Notarization isn’t mandatory but adds legal strength.

Yes, by submitting a new authorization letter and updating details on the GST portal.

It remains valid until revoked or replaced by another letter.

You can download the Word format here once uploaded.

The GST department needs proof that the person managing GST matters is officially allowed to do so. Without this letter, GST applications or filings may be rejected.

An authorized signatory can be a business owner, partner, director, employee, accountant, or GST consultant, as long as the business gives written approval through an authorization letter.

Yes, it is compulsory for partnership firms, LLPs, and companies. In the case of proprietorships, it is required only when someone else is handling GST work instead of the owner.

The letter should clearly mention the authorized person’s name, designation, contact details, business name, PAN, registered address, date, place, and signature of the business owner or partners.

Yes, rejection can happen if the signature does not match, important details are missing, the format is incorrect, or the letter does not match the GST application data.

Yes, it is always safer to issue the authorization letter on the official business letterhead to avoid unnecessary queries or rejection.

No, notarization is not required. A properly signed authorization letter on business letterhead is enough for GST purposes.

Yes, the same authorization letter can be used for GST registration, return filing, and other GST-related activities unless the authorized signatory changes.

To avoid rejection, ensure the letter is properly drafted, signed by the correct authority, matches the GST application details, and is uploaded in clear PDF format.

Final Thoughts on GST Authorization Letters

A Letter of Authorization for GST is more than just a formality—it’s a legal safeguard. Whether you’re a startup, a seasoned enterprise, or a growing partnership, drafting and submitting a proper letter ensures smooth GST compliance. Don’t underestimate its value—use our free templates to get started!

Get Professional Help

Avoid late fees, errors, and GST notices. We handle your GSTR-1 filing

📍 Location: Noida

👉 Charteredhelp – Your Trusted Partner for GST Compliance

Contact us today GST Return Filing in Noida

📞 Call Now

+91-9266685656

CharteredHelp is a team of experienced professionals providing tax, accounting, auditing, and compliance services for businesses and individuals. With over 10+ years of experience, we assist clients with GST registration and filings, income tax returns, company registration, trademark services, accounting, auditing, and handling tax notices. Our focus is on providing practical, reliable, and timely support to help clients stay compliant and grow their businesses with confidence.