GST on Gold Jewellery in India

GST on Gold Jewellery in India – Rates, Making Charges & Practical Guide (2026) When you buy gold jewellery, you don’t just pay for gold—you

Why Virtual Office GST Registration Gets Rejected?

Why Virtual Office GST Registration Gets Rejected? REG-03 Notice Explained In 2026, getting GST on a virtual office is no longer just about uploading documents.

GST on Furniture

GST on Furniture in India 2026 – Latest Rates, HSN Codes GST on Furniture in India 2026 decides how much tax you pay on raw

GST on Bricks

GST on Bricks in 2026: Latest GST Rate on Bricks, HSN Code & Impact on Brick Manufacturers GST has reshaped taxation in India since its

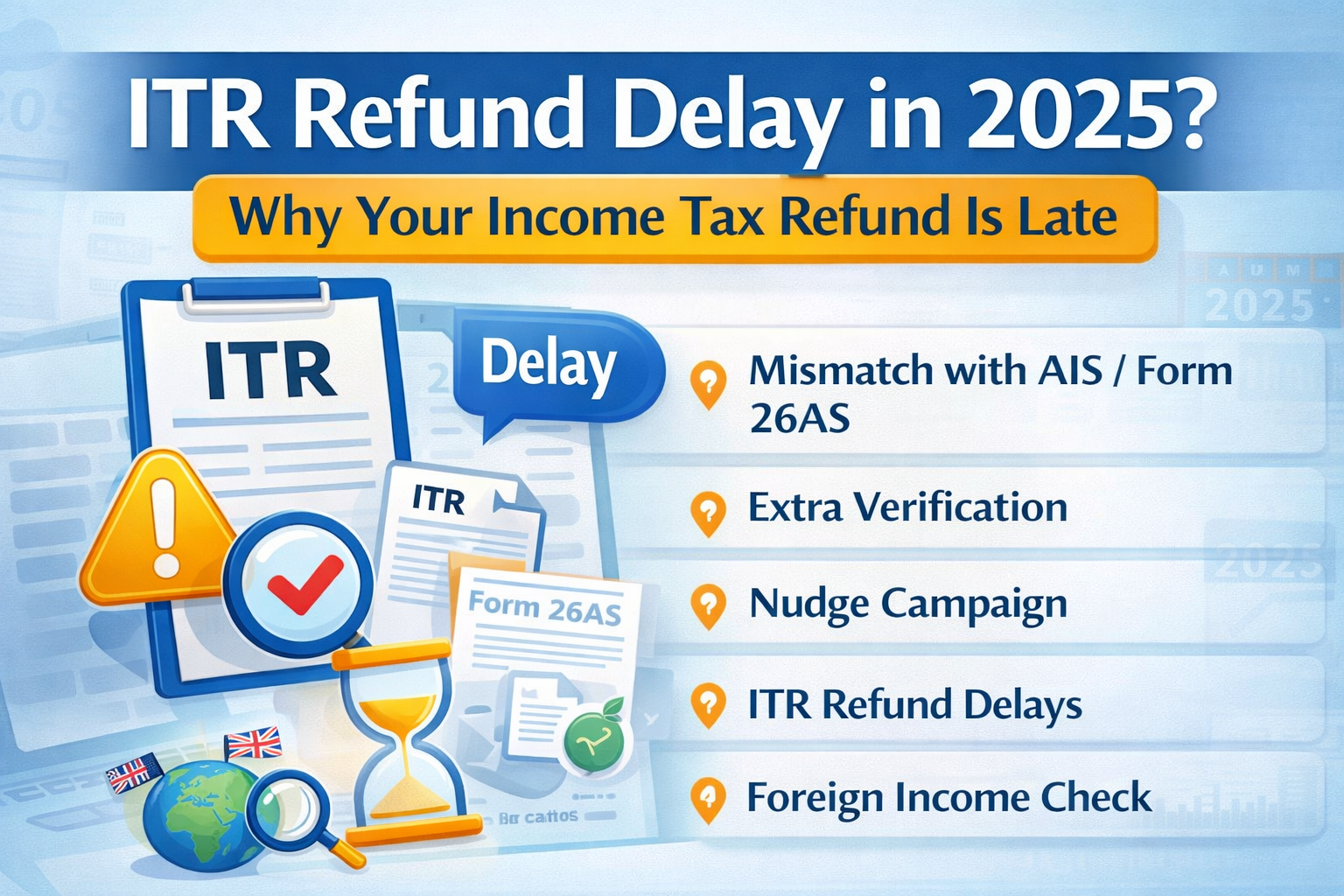

ITR Refund Delay

Main Reasons Why ITR Refunds Are Delayed Mismatch Between ITR and AIS / Form 26AS Income Tax “Nudge” Campaign Late Release of ITR Forms Extra

GST Notice Reply

Received a GST Notice? Types of GST Notices & How to Reply Online Receiving a GST notice can be stressful, especially for small business owners,

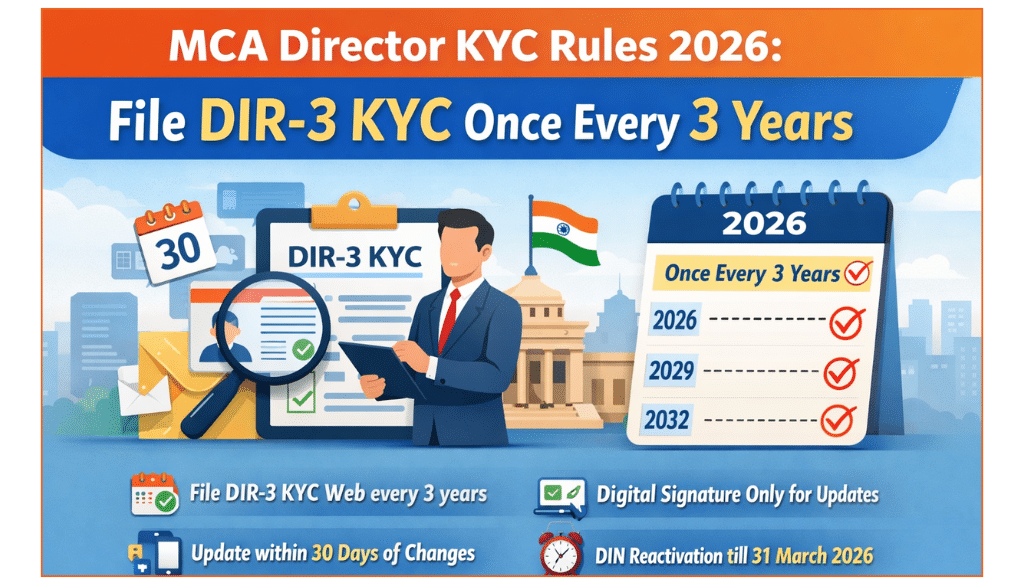

MCA Director KYC Rules 2026

MCA Director KYC Rules 2026: File DIR-3 KYC Once Every 3 Years The Ministry of Corporate Affairs (MCA) has announced a significant change in Director

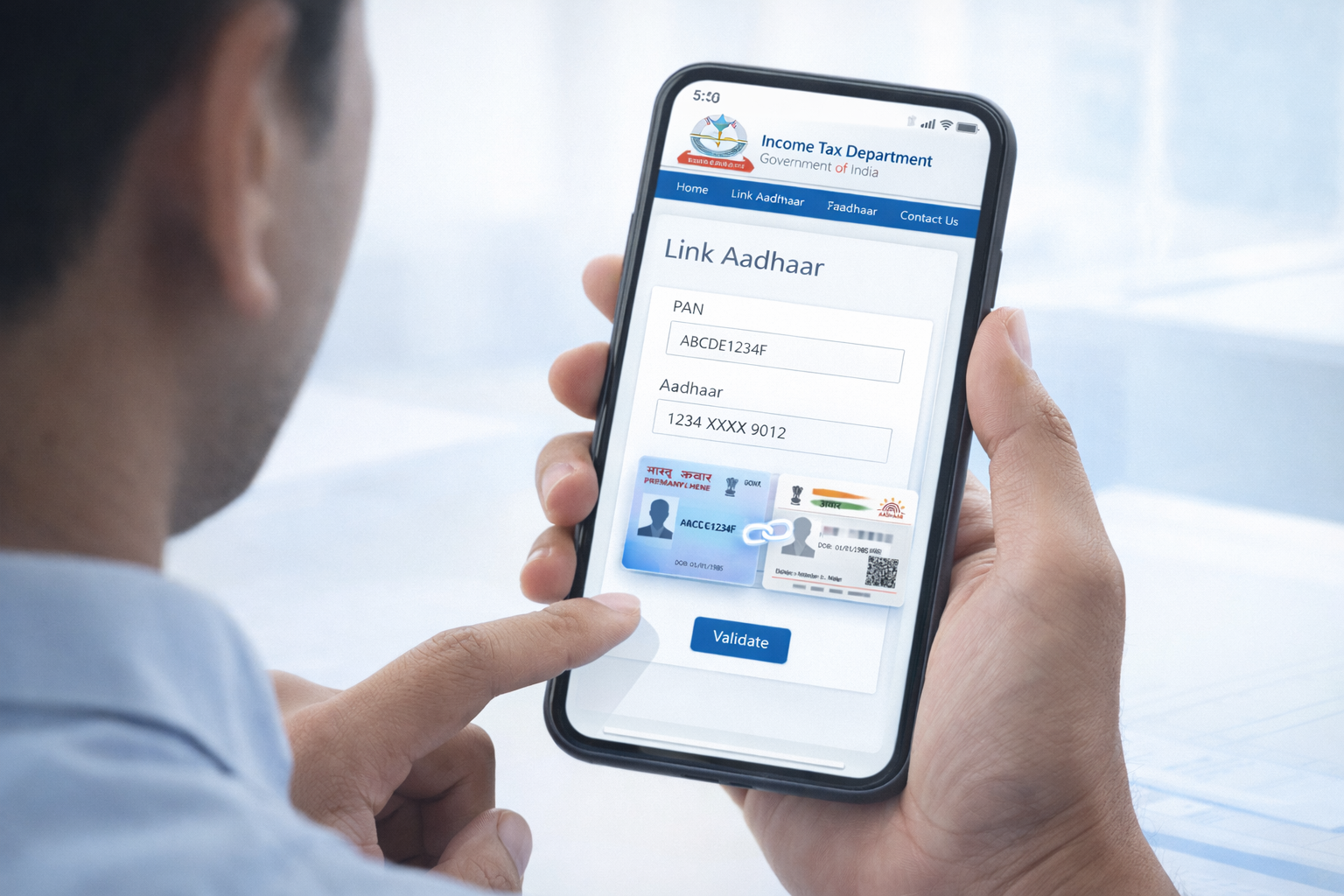

Pan Card & Aadhar Link 2026

Pan Card & Aadhar Link 2026 – Complete Step-by-Step Guide Is your Pan card not linked with your Aadhar yet? If yes, your Pan may

Google Map

Recent Posts

GST on Gold Jewellery in India

GST on Gold Jewellery in India – Rates, Making Charges & Practical Guide (2026) When you buy gold jewellery, you...

Why Virtual Office GST Registration Gets Rejected?

Why Virtual Office GST Registration Gets Rejected? REG-03 Notice Explained In 2026, getting GST on a virtual office is no...

GST on Furniture

GST on Furniture in India 2026 – Latest Rates, HSN Codes GST on Furniture in India 2026 decides how much...