TDS Applicability on Proprietorship Firm

Introduction to TDS and Its Importance Before understanding TDS applicability on proprietorship firm let first understand the TDS. Tax Deducted at Source (TDS) is a

Mandatory First Auditor Appointment

Mandatory Form ADT-1 Filing in Case of First Auditor Appointment: Starting 14 July 2025, the Ministry of Corporate Affairs (MCA) has introduced a crucial compliance

Fixed Assets File

Fixed Assets: The Foundation of Financial Discipline Fixed assets are long-term resources that generate economic value for businesses. In India, they typically include: Plant &

Net Worth Certificate for Visa

Introduction to Net Worth Certificate for Visa A Net Worth Certificate for Visa is a vital financial document required by many embassies to verify that

44 days, 3 Queries, 4 lakhs Saved: The Lower Deduction Certificate Battle

Introduction When our NRI client approached us for help with a Lower Deduction Certificate (LDC) to sell property in India, we were clear-eyed about the

Legality of Demanding Detailed Documents via Form ASMT‑10 (Scrutiny of Returns)

Introduction Under the GST law, scrutiny of returns (Section 61, CGST Act 2017) is a limited-scope review of a taxpayer’s filed returns. A GST officer

Documents Required for Wholesale Drug License

Wholesale Drug License Registration If you’re planning to enter the pharmaceutical distribution business, obtaining a wholesale drug license is a non-negotiable legal requirement. The process

CA near me for ITR Filing in Noida

CA Near Me for ITR Filing in Noida – Fast, Accurate & Hassle-Free If you’re searching for a CA near me for ITR filing in

Google Map

Recent Posts

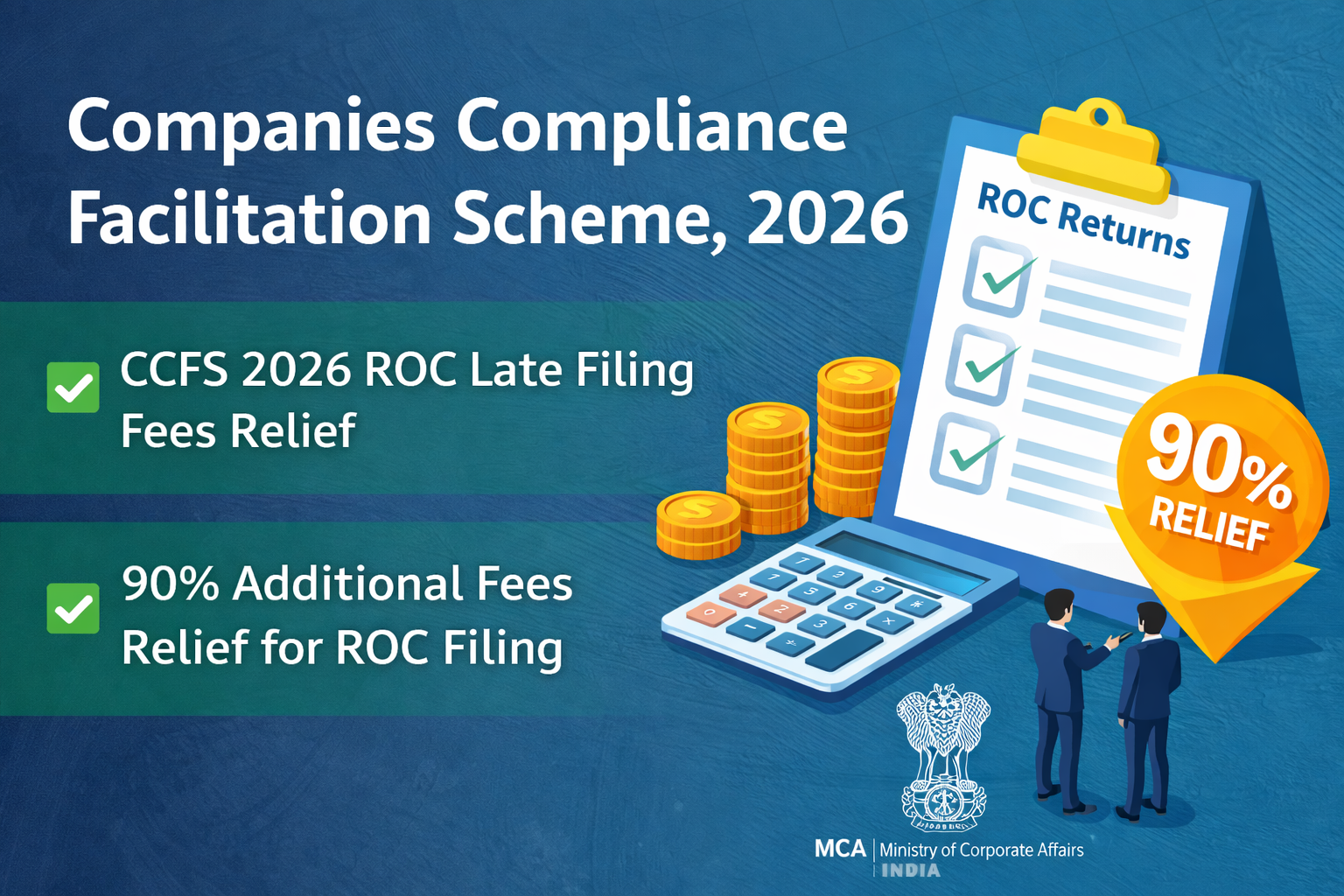

Companies Compliance Facilitation Scheme (CCFS), 2026

About Companies Compliance Facilitation Scheme, 2026 The Companies Compliance Facilitation Scheme, 2026 (CCFS 2026) is a one-time compliance window introduced...

MCD Trade License Renewal Online Delhi

MCD Trade License Renewal - Complete 2026 Step-by-Step Guide If your business is running in Delhi, MCD Trade License Renewal...

GST Compliance Explained: Registration, Returns, Penalties & Benefits

GST Compliance GST Compliance is one of the most critical responsibilities for any business registered under Goods and Services Tax...