Section 194R TDS

Section 194R TDS on Benefits & Perquisites (Business) If you’re a business owner, professional, or accountant in India, you can’t afford to ignore TDS Section

ITR Due Date Extended for FY 2024-25 (AY 2025-26): Here’s What You Need to Know

ITR Due Date Extended for FY 2024-25 (AY 2025-26) to 15th September, 2025 Good news for taxpayers! The ITR due date extended by the Income

Difference Between Sole Proprietorship and One Person Company (OPC)

Introduction to Business Structures in India When starting a business, choosing the right legal structure is a critical step. Among the most popular options for

Bank Account में कितना पैसा रखना सही है?

Bank Account में कितना पैसा रखना सही है? जानिए नई लिमिट्स और Income Tax के Rules! Notice से बचना है तो Account ऐसे Maintain करें

Gift Deed Format

What is a Gift Deed? A gift deed is a legal paper through which a person (called the donor) gives their movable or immovable property

GST on Maintenance Charges by RWA

🧾 Is GST Applicable on Monthly Maintenance Charges? Here’s the Clarification If you live in a housing society or apartment complex, you’re probably paying monthly

Tax on Crypto in India

Introduction to Tax on Crypto in India 2025 Cryptocurrency has swiftly evolved from being a speculative digital asset to a mainstream financial instrument. With increasing

GST Rate on Laundry Services and HSN Code

HSN Code and GST Rate on Laundry Services: Laundry services, including dry cleaning and garment care, fall under the Goods and Services Tax (GST) regime

Google Map

Recent Posts

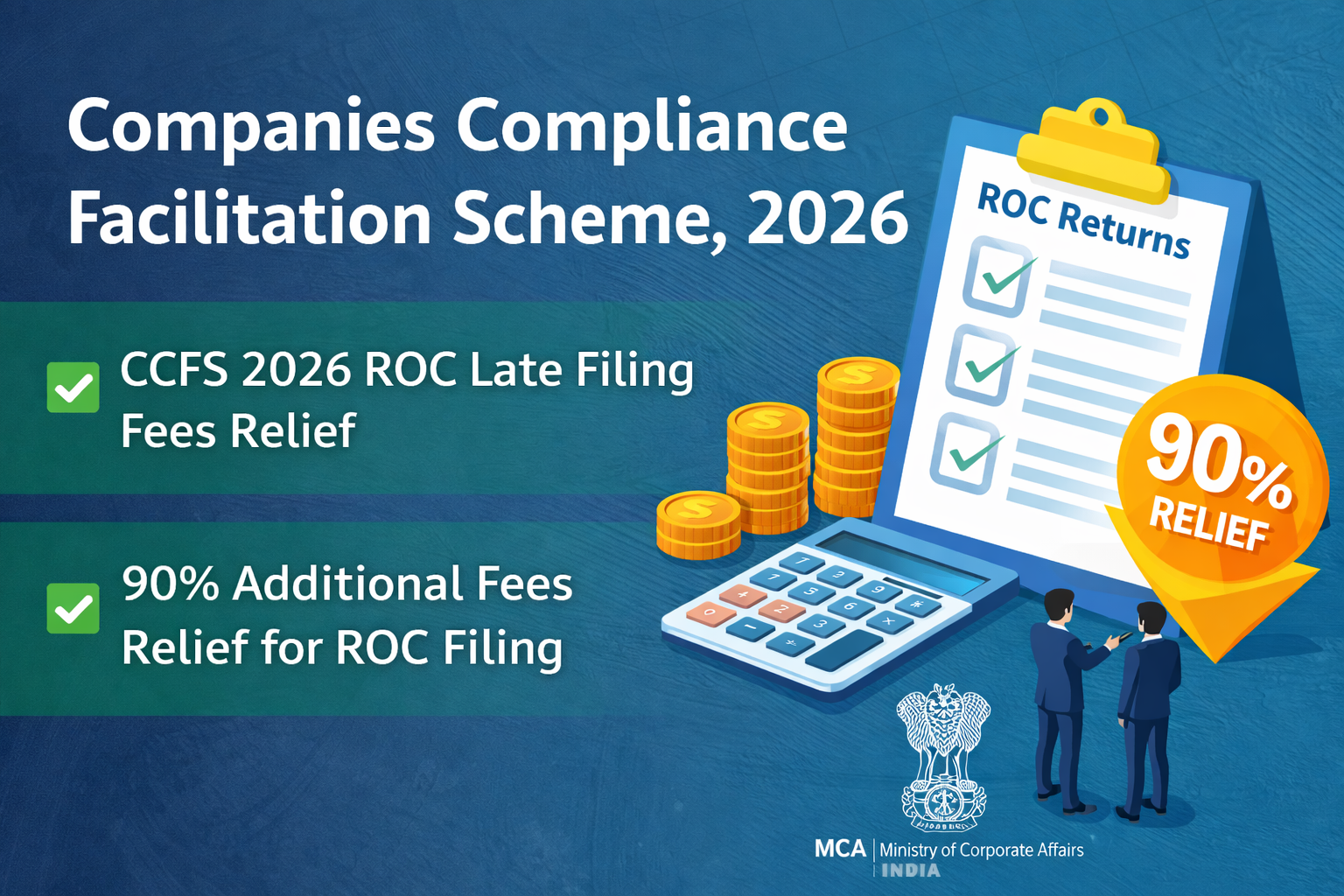

Companies Compliance Facilitation Scheme (CCFS), 2026

About Companies Compliance Facilitation Scheme, 2026 The Companies Compliance Facilitation Scheme, 2026 (CCFS 2026) is a one-time compliance window introduced...

MCD Trade License Renewal Online Delhi

MCD Trade License Renewal - Complete 2026 Step-by-Step Guide If your business is running in Delhi, MCD Trade License Renewal...

GST Compliance Explained: Registration, Returns, Penalties & Benefits

GST Compliance GST Compliance is one of the most critical responsibilities for any business registered under Goods and Services Tax...