Companies Compliance Facilitation Scheme (CCFS), 2026

About Companies Compliance Facilitation Scheme, 2026 The Companies Compliance Facilitation Scheme, 2026 (CCFS 2026) is a one-time compliance window introduced by the Ministry of Corporate

About Companies Compliance Facilitation Scheme, 2026 The Companies Compliance Facilitation Scheme, 2026 (CCFS 2026) is a one-time compliance window introduced by the Ministry of Corporate

MCD Trade License Renewal – Complete 2026 Step-by-Step Guide If your business is running in Delhi, MCD Trade License Renewal Online Delhi is not just

GST Compliance GST Compliance is one of the most critical responsibilities for any business registered under Goods and Services Tax in India. Even a small

ITR Notice Received? What to Do Next (Step-by-Step Guide) If you have recently seen an email or message from the Income Tax Department and your

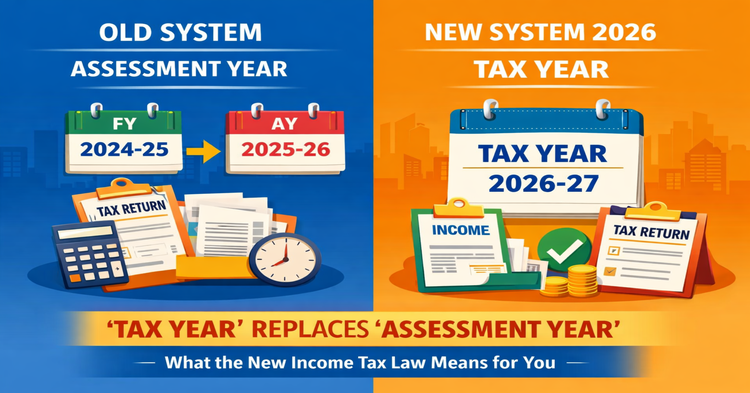

‘Tax Year’ Replaces ‘Assessment Year’: What the New Income Tax Law Means for You For years, Indian taxpayers have been confused by terms like Financial

GST on Gold Jewellery in India – Rates, Making Charges & Practical Guide (2026) When you buy gold jewellery, you don’t just pay for gold—you

Why Virtual Office GST Registration Gets Rejected? REG-03 Notice Explained In 2026, getting GST on a virtual office is no longer just about uploading documents.

GST on Furniture in India 2026 – Latest Rates, HSN Codes GST on Furniture in India 2026 decides how much tax you pay on raw

About Companies Compliance Facilitation Scheme, 2026 The Companies Compliance Facilitation Scheme, 2026 (CCFS 2026) is a one-time compliance window introduced...

MCD Trade License Renewal - Complete 2026 Step-by-Step Guide If your business is running in Delhi, MCD Trade License Renewal...

GST Compliance GST Compliance is one of the most critical responsibilities for any business registered under Goods and Services Tax...

WhatsApp Us